Living Benefits vs. Accelerated Death Benefits: What's the Difference?

When researching life insurance, you may come across two similar-sounding terms: living benefits and accelerated death benefits. While they both allow policyholders to access money from their life insurance policy while still alive, they are not exactly the same. Understanding the difference can help you choose the right type of coverage for your financial and health needs.

What Are Living Benefits?

Living benefits refer to a broader category of policy features that allow you to receive a portion of your death benefit before you pass away. These benefits are triggered by specific health-related events, such as:

- A critical illness like cancer, stroke, or heart attack

- A chronic illness that affects your ability to perform daily activities

- A terminal illness with a limited life expectancy (usually 12–24 months)

Funds received through living benefits can be used for any purpose: medical expenses, caregiving, household bills, or anything else you choose. Depending on the insurance provider, these benefits may be included in your policy or available through optional riders.

What Are Accelerated Death Benefits?

Accelerated death benefits (ADB) are a type of living benefit—but more specifically, they are usually associated with terminal illness. An ADB allows you to access a portion of your life insurance policy’s death benefit if you are diagnosed with a terminal illness and have a limited life expectancy.

The payout helps you cover end-of-life expenses, medical costs, or financial obligations while you’re still alive. In most policies, ADBs are included automatically at no additional cost.

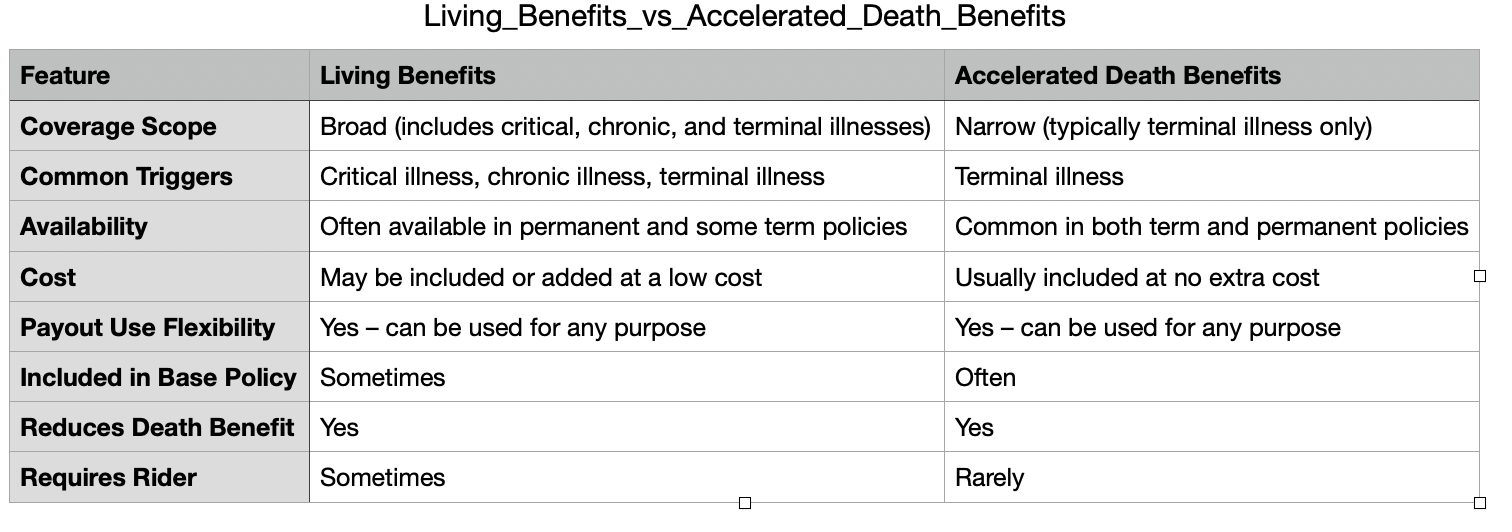

Key Differences Between Living Benefits and Accelerated Death Benefits

1. Scope of Coverage

- Living Benefits: Cover a wide range of serious health conditions, including critical and chronic illnesses.

- ADB: Typically limited to terminal illnesses only.

2. Policy Availability

- Living Benefits: May require additional riders or come with whole or universal life policies.

- ADB: Commonly built into both term and permanent policies.

3. Flexibility and Use

- Living Benefits: More flexible and comprehensive. Often include multiple triggers for access.

- ADB: Narrower in scope but serves a specific and important purpose.

4. Cost

- Living Benefits: May come with a small added premium if added as a rider.

- ADB: Typically included at no cost.

5. Impact on Death Benefit

Both options reduce the final death benefit paid to your beneficiaries. The amount you receive while living is subtracted from the policy’s payout after death.

Which One Is Right for You?

If you're only concerned about financial support in the final stages of life, an accelerated death benefit may be enough. But if you're looking for broader protection—like coverage for a stroke, major surgery recovery, or long-term care needs—living benefits offer more flexibility.

For maximum protection, look for a policy that includes both. Many life insurance providers now offer comprehensive living benefit riders alongside standard ADB provisions.

Final Thought

While accelerated death benefits are a specific type of living benefit, they don’t offer the same level of versatility or breadth. If you want life insurance that can support you during various health events—not just terminal illness—explore policies with full living benefits. They provide more ways to access your coverage when you need it most, giving you and your family greater financial peace of mind.